All Categories

Featured

Table of Contents

Utilizing the above example, when you secure that very same $5,000 funding, you'll earn returns on the whole $100,000. It's still totally funded in the eyes of the mutual life insurance coverage business. For limitless financial, non-direct acknowledgment plan finances are perfect. Finally, it's crucial that your policy is a mixed, over-funded, and high-cash worth plan.

Motorcyclists are additional features and advantages that can be added to your plan for your details requirements. They allow the policyholder acquisition extra insurance coverage or transform the conditions of future purchases. One factor you may want to do this is to prepare for unforeseen health issue as you age.

If you include an extra $10,000 or $20,000 upfront, you'll have that cash to the bank from the start. These are just some actions to take and think about when setting up your way of life financial system. There are numerous various methods which you can take advantage of way of life banking, and we can help you discover te best for you.

Infinite Banking Insurance Agents

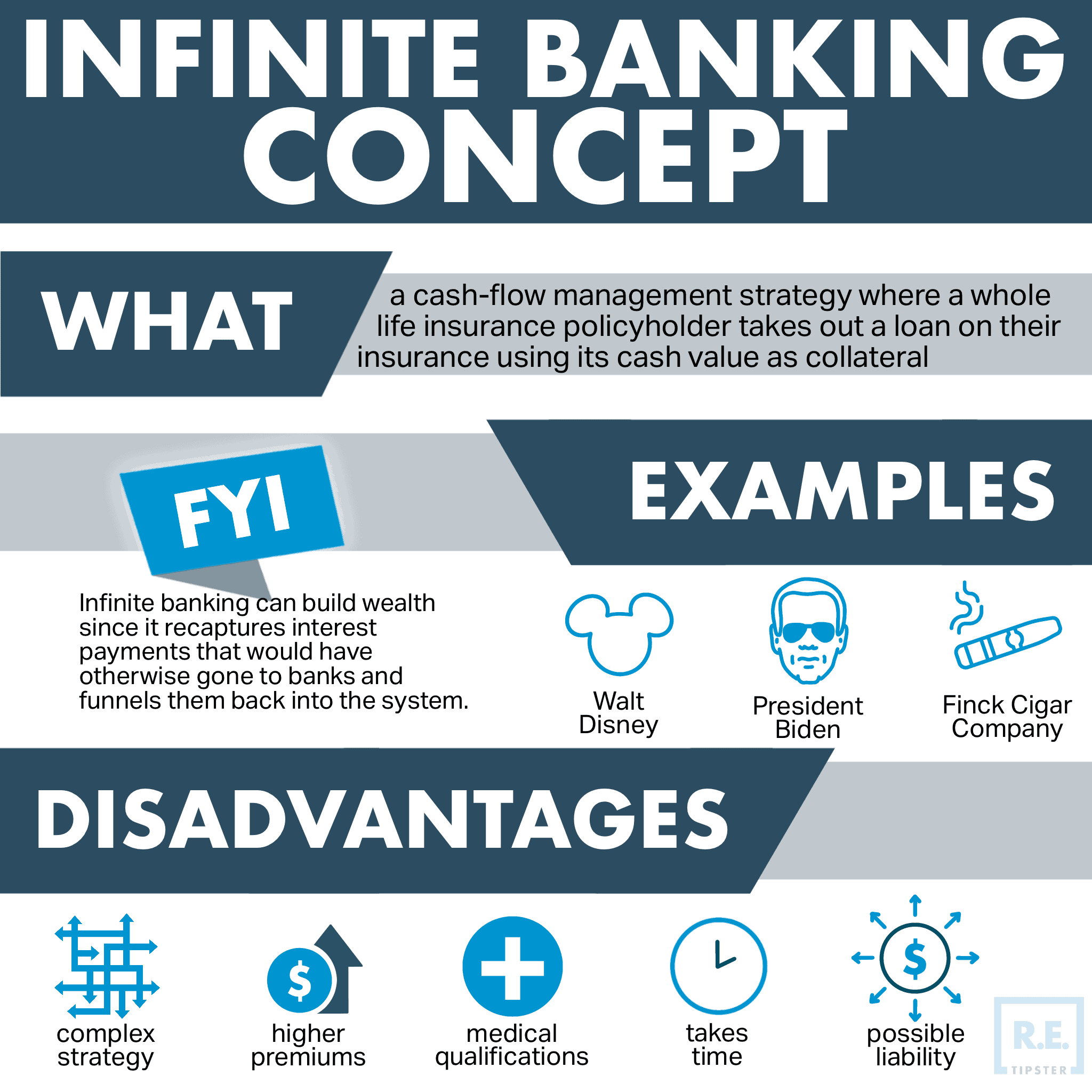

When it comes to monetary planning, whole life insurance policy usually stands out as a preferred option. While the idea may appear enticing, it's essential to dig deeper to recognize what this truly means and why watching whole life insurance policy in this method can be deceptive.

The idea of "being your very own bank" is appealing due to the fact that it suggests a high level of control over your financial resources. This control can be illusory. Insurer have the utmost say in just how your plan is handled, consisting of the terms of the lendings and the rates of return on your cash worth.

If you're considering whole life insurance policy, it's necessary to see it in a broader context. Entire life insurance policy can be an important tool for estate planning, providing a guaranteed survivor benefit to your beneficiaries and possibly offering tax benefits. It can additionally be a forced savings automobile for those that battle to conserve cash regularly.

It's a form of insurance coverage with a financial savings part. While it can provide consistent, low-risk growth of money value, the returns are usually less than what you may accomplish through various other financial investment vehicles. Before leaping into entire life insurance coverage with the concept of boundless financial in mind, put in the time to consider your monetary goals, danger tolerance, and the complete series of financial items offered to you.

Boundless financial is not a financial panacea. While it can work in certain situations, it's not without threats, and it needs a substantial commitment and comprehending to handle effectively. By recognizing the possible challenges and recognizing the real nature of whole life insurance policy, you'll be much better equipped to make an enlightened choice that supports your monetary wellness.

Rather than paying financial institutions for points we need, like cars, residences, and college, we can buy means to keep more of our cash for ourselves. Infinite Banking technique takes an innovative method towards individual financing. The approach essentially entails becoming your own financial institution by using a dividend-paying entire life insurance policy plan as your financial institution.

Infinite Banking Testimonials

It provides substantial growth with time, changing the typical life insurance policy policy into a strong economic tool. While life insurance policy companies and financial institutions risk with the change of the market, the negates these risks. Leveraging a cash money value life insurance coverage policy, people enjoy the advantages of assured development and a survivor benefit secured from market volatility.

The Infinite Banking Concept shows just how much wealth is permanently moved away from your Family members or Service. Nelson also takes place to describe that "you finance whatever you buyyou either pay interest to somebody else or quit the interest you might have otherwise made". The actual power of The Infinite Financial Idea is that it solves for this trouble and equips the Canadians that embrace this concept to take the control back over their financing needs, and to have that cash moving back to them versus away.

This is called lost chance cost. When you pay cash for things, you completely offer up the opportunity to gain passion by yourself financial savings over numerous generations. To fix this trouble, Nelson developed his very own banking system via the use of dividend paying taking part whole life insurance policy policies, ideally with a mutual life firm.

Because of this, insurance holders should meticulously assess their monetary goals and timelines before selecting this strategy. Sign up for our Infinite Financial Course. Regain the passion that you pay to financial institutions and money companies for the major items that you require during a lifetime. Build and keep your Personal/ Service wealth without Bay Road or Wall Road.

Whole Life Infinite Banking

Exactly how to obtain Nonstop COMPOUNDING on the routine payments you make to your savings, emergency fund, and retired life accounts How to position your hard-earned money so that you will never ever have one more sleep deprived evening fretted regarding exactly how the markets are going to respond to the next unfiltered Governmental TWEET or international pandemic that your family members simply can not recuperate from Just how to pay on your own first using the core principles shown by Nelson Nash and win at the money video game in your own life How you can from 3rd event banks and lenders and move it into your own system under your control A structured way to make sure you pass on your wide range the means you desire on a tax-free basis How you can relocate your money from permanently taxed accounts and change them right into Never strained accounts: Listen to precisely just how individuals simply like you can implement this system in their own lives and the influence of putting it right into action! The duration for establishing and making considerable gains via unlimited banking mainly depends on various elements unique to a person's economic placement and the policies of the economic establishment catering the solution.

Moreover, a yearly returns settlement is another massive advantage of Boundless financial, additional emphasizing its attractiveness to those tailored towards long-term economic development. This strategy needs careful consideration of life insurance policy prices and the analysis of life insurance policy quotes. It's important to examine your credit rating record and face any type of existing charge card debt to guarantee that you remain in a beneficial position to embrace the approach.

A vital facet of this method is that there is ignorance to market changes, because of the nature of the non-direct recognition fundings made use of. Unlike financial investments connected to the volatility of the markets, the returns in limitless financial are stable and foreseeable. Nonetheless, added money beyond the premium settlements can likewise be included to quicken growth.

Royal Bank Infinite Avion Travel Insurance

Policyholders make routine costs settlements into their getting involved whole life insurance coverage policy to maintain it in pressure and to build the plan's complete cash money value. These premium repayments are generally structured to be constant and foreseeable, ensuring that the plan remains active and the money worth continues to grow over time.

The life insurance policy policy is made to cover the entire life of a private, and not simply to assist their recipients when the private passes away. That claimed, the plan is participating, meaning the policy owner comes to be a component owner of the life insurance firm, and takes part in the divisible revenue generated in the form of dividends.

When dividends are chunked back right into the policy to purchase paid up enhancements for no added price, there is no taxed event. And each paid up addition also obtains returns every solitary year they're declared. infinite bank statement.

Latest Posts

Direct Recognition Life Insurance Companies

How To Create Your Own Bank

The Concept Of Becoming Your Own Bank